Find the Best CFD Broker to Trade Online

Online CFD trading is growing in popularity as active investors use more sophisticated strategies to boost investment returns. When making an online CFD trade, you obtain a return that mirrors the performance of an underlying security or asset on which the contract is based. A key component of these instruments is margin which magnifies the potential profits – and losses – that the holder of the contract can obtain. While some investors are intimidated by the prospect of speculating on financial markets with derivatives, CFDs offer the opportunity to earn great returns if a professional strategy is implemented. In this review, Realmoney.co.uk looks at the key factors to consider when deciding which real money online CFD broker to trade with.

| Casino |

Rating |

Highlight |

Bonus |

Trusted Link |

Terms and Conditions |

| CMC Markets |

5 ★ excellent |

- Tight Spreads On 10,000+ Instruments

- 25+ Years’ Experience

|

Next Gen Trading Platform |

Trade Here |

Trading involves a high risk of loss. T&Cs Apply |

How to Find the Best Broker

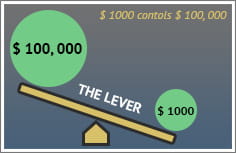

A major factor in the growing popularity of CFDs among UK retail investors is the leverage that the products offer. In comparison to other financial instruments, CFDs offer a very high level of leverage. The less margin a trader is required to stump up, the higher the potential profits – and losses – on a trade. Another key advantage that these instruments have over traditional investment vehicles such as shares is that an investor can take either a long or a short position. This means, for example, a trader can bet on a share such as Facebook falling – as well as rising. So-called-shorting of shares and other assets and securities can be valuable for investors seeking to speculate on falling prices or hedging the risk exposure of their portfolio. CFDs are sophisticated tools for trading financial markets.

In recognition of the growing appeal of real money trading with CFDs among retail investors, brokers are developing increasingly advanced online trading platforms for the trading of the products. These platforms allow investors to trade in a wide variety of markets from a single portal that offers real time quotes. Ideally, you should choose an online broker that lets you trade in shares, commodities, Forex and indices. CFD trading platforms are often available in different formats to trade on your laptop, PC or handheld device. When choosing a broker you should carefully assess the functionality and trading options available on the platform and how it is available on your desktop or handheld device.

Claim Your Bonus

Increasing competition in the CFD brokerage space has spurred many real money trading brokers to offer new clients a bonus. However, you should read the small print as terms and conditions usually apply on such offers. You may be required to make a minimum amount of trades or profit before you’re able to make a money transfer of the bonus into your bank account.

Trade CFDs Online with Leverage

In essence, leverage means that you can trade CFDs with a deposit that is only a small fraction of the value of the trade that you open. This means, for example, that you could use a margin of £1,000 to trade a positon of £10,000 shares. The profit you can earn would be the same as if you owned the £10,000 of stock. The flip side of the coin is that if the shares plummet it can not only wipe out your £1,000 deposit but also leave you with a sizeable debit balance. Always remember that leveraged trading carries a high level of financial risk. Make sure that a broker offers a stop-loss on trades, whereby you can pre-define at what price you would like a trade to be closed should markets turn against you.

In essence, leverage means that you can trade CFDs with a deposit that is only a small fraction of the value of the trade that you open. This means, for example, that you could use a margin of £1,000 to trade a positon of £10,000 shares. The profit you can earn would be the same as if you owned the £10,000 of stock. The flip side of the coin is that if the shares plummet it can not only wipe out your £1,000 deposit but also leave you with a sizeable debit balance. Always remember that leveraged trading carries a high level of financial risk. Make sure that a broker offers a stop-loss on trades, whereby you can pre-define at what price you would like a trade to be closed should markets turn against you.

However, be aware that in the event of extreme market conditions a broker may close a position at a worse level than your pre-defined stop-loss. Alternatively, some brokers offer price alerts whereby clients obtain notification when a pre-defined price level has been reached on securities or assets.

Spreads and Fees When Trading CFDs Online

The spread, which is the difference between the buy and sell price, is the primary trading cost. The narrower the spread between the bid and offer price, the cheaper it is to trade. A tight spread means there is very little headroom for the price of a security to move before a trade generates a profit – or loss. It is important to understand that when a trade is opened, the trading position will display a loss equal to the size of the spread. If a broker is offering a spread of three pence on an equity CFD, the share will need to increase in price by three cents for the open position to break even. When looking for the best broker you should compare the spreads available on the assets and securities that you are interested in trading when you open an account. You should also check if there are any commissions payable on trades. An additional cost of trading is the ‘holding cost’ of keeping a position open overnight. Holding cost fees vary depending upon the direction of an open position and the holding rate fees charged by the broker.

The Smart Way of Trading Online

As these are sophisticated financial instruments you would expect brokers to offer a variety of charting and analytical tools to inform your trading decisions. Competition in the increasingly crowded CFD broker space has fostered innovation with many brokers offering a wide variety of charting and analytical tools. Charting tools available include alligator, bollinger bands, fractals, moving average, relative strength index and standard deviation. Charting tools can help you trade Forex CFDs better, along with a variety of other instruments.

- Tight spreads

- Low margin requirements

- Higher leverage

- Guaranteed stops

- Zero fees

- Contingent orders

Beware the Scam Brokers

Before you sign up with a CFD broker it is vital that you do some due diligence checks to make sure that your funds will be safe. Make sure that your broker is regulated and fully authorised in the UK, falling under the remit of the Financial Conduct Authority (FCA). A good level of customer service is also vitally important. Check if customer support is available 24 hours a day, seven days a week, particularly if you are trading Forex instruments which are traded around the clock. Many brokers offer a live online chat function. Ideally, you should also be able to telephone a customer service representative and have a postal address in order that you can make a written inquiry by post.

Risk Warning:CFDs are a leveraged product and can result in the loss of your entire capital. Trading CFDs may not be suitable for you. Please ensure you fully understand the risks involved.